Between dealer inventories, the trade show effect and the delivery schedule, a nautical year can't be read in one go. The figures published on February 9 show one thing above all: Groupe Beneteau slowed the slide in H2 2025, and is now betting on a recovery in 2026, with a largely renewed range.

H2 2025, a clear upturn after a sharply contracting H1

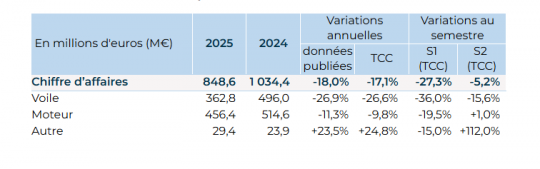

Sales for 2025 came to ?848.6 million, down 17.1% at constant exchange rates. But the picture changes when the year is cut in half.

In H1 2025, sales fell by 27.3% at constant exchange rates, to ?403.8m from ?556.6m in 2024. In H2 2025, sales totaled ?444.8 million, compared with ?477.8 million a year earlier, a decline limited to 5.2% at constant exchange rates.

This contrast is the central element of the release. It tells of a market that first digested stocks, then began to recommend, more cautiously, but on a more regular basis.

Fourth-quarter sales came to ?274.2m, compared with ?298.3m in Q4 2024. The Group reports an impact of around ?20 million due to customs clearance delays in the United States. Without this effect, sales would have been stable at constant exchange rates over the period.

23 new models in 2025, and orders on the rise

Groupe Beneteau reports a 24% increase in order intake for the year. This momentum is attributed to the success of the 23 new models launched in 2025, and to the sales policy deployed at recent boat shows.

Bruno Thivoyon sums up the angle chosen by the Group with a quote that, this time, has the merit of being precise. "In a difficult market context, our strategy of accelerating product launches has paid off," says Bruno Thivoyon, Chairman of the Groupe Beneteau Management Board.

In terms of market reading, the challenge is not just to launch. It's about launching at the right time, with units that trigger end-customer action, and not just curiosity on a pontoon.

Sailing, a year down, but a less gloomy end to the year

Sailing will account for 44% of the Group's yacht sales in 2025. Over the year, sales were down 26.6% at constant exchange rates. The Group explains this downturn by weak end demand for monohulls and a marked slowdown among professional charterers.

The S2, however, changes the slope, with an improvement driven by new features. On the monohull side, the press release cites the Oceanis 47 and Oceanis 52 (Beneteau) and the Sun Odyssey 415 (Jeanneau). In the multihull segment, three catamarans presented at the Cannes Yachting Festival - the Lagoon 38, Excess 13 and Lagoon 82 - helped bolster sales, with H2 down 5% at constant exchange rates, versus 31% in H1, a period also partly disrupted by an ERP change.

Motor, trend reversal in H2 driven by Europe

The Engine segment accounts for 56% of the Group's boat sales. Over the full year, sales fell by 9.8% at constant exchange rates, but there was a clear shift between half-years. H1 sales fell by 19.5% at constant exchange rates, while H2 sales rose by 1.0%.

The press release points to a rebound in motorboat sales in Europe in H2. In Motor Yachting, Prestige maintained its strong momentum with the M Line motor catamarans. At Beneteau, the launch of the Swift Trawler 37 and Gran Trawler 63 strengthens commercial traction in the second half.

In dayboating, American brands are continuing the recovery that began at the end of 2024, with the Wellcraft 38 T Top, and the renewal of Four Winns' access offers.

To put it plainly, the engine is playing its role as a shock absorber, provided that the distribution networks regain a healthy rhythm between deliveries and final sales.

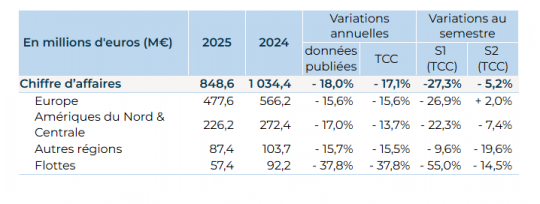

Europe, the Americas, fleets: dynamics that don't tell the same story

In Europe, the H1 fall, to 26.9% at constant exchange rates, was followed by a +2.0% H2. The press release points out that the weakness of the French market was largely offset by the strong momentum of Motor Yachting in Italy.

In North and Central America, sales were down 13.7% at constant exchange rates over the year, with H2 down 7.4%. The Group cites consumer confidence affected by economic uncertainties, but emphasizes one specific point: in dayboating, US brands grew by 18% at constant exchange rates, mitigating the slowdown in sales from Europe, itself penalized by a weaker dollar and the introduction of customs tariffs in the USA.

Finally, fleets remain the segment with the biggest decline, down 37.8% over the year. The press release cites Greece, where the end of certain subsidy schemes has weighed on demand from professional rental companies.

Cash flow incident: a closed subject, but closely monitored

One point, unusual in a nautical commercial communication, concerns cash flow. On December 23, 2025, a service provider responsible for distributing transfer orders mistakenly reissued orders that had already been executed. The banks initiated reminder procedures, and by February 9, 2026, over 96% of the sums had been recovered. The Group considers the residual impact to be insignificant, and will announce details of the accounting treatment as at December 31, 2025 when it publishes its annual results, scheduled for March 18, 2026.

The Group also points out that, apart from this timing difference, net cash remains at first-half year-end levels, with positive operating cash flow generation for the year.

2026, the Group announces a return to growth in the first half of the year

Groupe Beneteau confirms a return to growth in 2026, with a more marked increase expected in the first half of the year. The press release cites encouraging signs at trade shows, notably the Paris Nautic Show and boot Düsseldorf, where final sales are said to have rebounded significantly.

The product trajectory is clear: 66 new models announced between 2025 and 2027, with two desired effects. On the one hand, a move upmarket in several segments, and on the other, a revival of entry-level volumes. The Group adds that, for the first time in three years, the order backlog at the start of 2026 provides greater visibility than the previous year.

/

/