The second quarter of 2025 proved a mixed bag for Brunswick Corporation. The American manufacturer, active across the entire nautical chain (engines, equipment, electronics, boats, services), is seeing its margins contract under the impact of customs duties imposed by the new Trump administration and persistent industrial tensions. Despite this, the Group is maintaining its long-term strategy and posting historically high cash flows.

Stable sales, sharply contracting margins

Net sales for the second quarter reached $1.447‚eurosĮMd‚eurosĮ$, up a very slight 0.2‚eurosĮ% on 2024. However, operating profit fell by 34.7% ($103.3 million on a GAAP basis), with a margin of 7.1%. On an adjusted basis, the decline remained marked: operating income was ‚EUR30.3‚eurosĮ% (126‚eurosĮM‚eurosĮ$), with a margin of 8.7‚eurosĮ%. This decline is explained by price pressure on components, low absorption of industrial capacity and a cautious sales policy.

Wide disparities between segments: propulsion resilient, boats in decline

The rear-wheel drive segment posted growth of 7.2% to $598.2 million, driven by OEM orders in the USA. However, profitability fell by 23.1‚eurosĮ%. Parts and accessories grew slightly (+0.5‚eurosĮ%), but operating income fell by 5.2‚eurosĮ%. The Boats segment suffered the sharpest decline, with sales down ‚euros6.6‚eurosĮ% to ‚euros405.6‚eurosĮ and operating income down ‚euros55.2‚eurosĮ% to just ‚euros11.1‚eurosĮ. The Navico group, specializing in on-board electronics, saw its sales fall by 3.7‚eurosĮ%, despite positive adjusted earnings of $10.8‚eurosĮM‚eurosĮ$.

Freedom Boat Club and recurring revenues as cyclical shock absorbers

Almost 60‚eurosĮ% of adjusted operating income for the quarter now comes from recurring revenue activities‚eurosĮ: spare parts, re-motorization, Freedom Boat Club subscriptions, Navico sales. Freedom Boat Club, now active in Duba√Į, alone accounts for 12‚eurosĮ% of Boat segment sales. This hybrid business model, combining sales and services, enables Brunswick to mitigate the cyclicality of new unit sales, particularly in times of economic uncertainty.

Historical cash flows and sustained investments

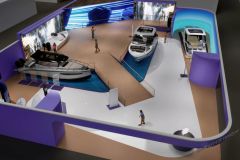

Free cash flow reached $288 million, a record for a second quarter. Six-month free cash flow amounted to 244‚eurosĮM‚eurosĮ$, compared with ‚euros35‚eurosĮM‚eurosĮ$ a year earlier. This financial strength enabled Brunswick to buy back 43.1‚eurosĮM‚eurosĮ$ worth of shares and distribute 56.6‚eurosĮM‚eurosĮ$ in dividends. The Group continues to forecast more than $400 million in cash flow for 2025. The investment effort remains focused on connected products and digital tools, including an autonomous reception system expected by the end of 2025, and the integration of AI into software development and customer support.

/

/