Profitability maintained by pricing discipline

The first obvious fact is cost control. The Group has announced an EBITDA margin of 15.1%, despite an estimated negative currency effect of 26 million euros. Clearly, growth is achieved not through sales growth, but through a strict pricing policy, coupled with reductions in operating expenses.

Overall sales down, but organic sales up

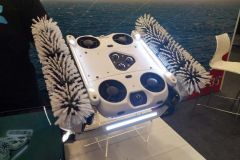

Over the quarter, AkzoNobel posted sales of 2.55 billion euros, down 5% on 2024. This decline was mainly due to the currency effect, as the stronger euro weighed on export sales. On a like-for-like basis, however, organic sales were up 1%, reflecting continued demand in key sectors, including yachting and coatings for marine environments.

This data is worth keeping an eye on for marine distributors and applicators, as it underlines the fact that certain segments (notably premium and technical) continue to perform well, even in a tense economic climate.

Exceptional provision for litigation in Australia

The main black mark on the quarter was an exceptional charge of 300 million euros. This relates to a provision for a long-running legal dispute concerning the Ichthys gas project in Australia. Although not directly related to the yachting business, this litigation has a mechanical impact on operating income, and could delay industrial investments, particularly on the most specific production lines.

For equipment manufacturers and construction sites working with AkzoNobel, this budgetary reserve could mean a temporary freeze on certain innovations or a slowdown in line modernization.

Impact on the marine sector and French shipyards

Lastly, the third quarter was marked by restructuring in France. At the beginning of 2025, AkzoNobel announced a reduction in its French payroll, while injecting 22 million euros into the Montataire site to modernize it. These contradictory moves reflect a strategy of industrial specialization, with sites concentrating on high value-added products.

/

/